net 30 meaning|net 30 vs net 60 : Cebu Net-30 refers to the time frame in which a customer must pay the full amount of a vendor's invoice within 30 days or less. It .

PCSO Swertres Hearing Maintain Today. Friday, May 03, 2024 – Here are the PCSO Swertres Hearing today, Swertres Hearing Online, 3D Hearing, Pinoy Swertres Hearing Tips Probable, Swer3 Hearing Calendar Guide, Swertres Pasakay Pairing, and analysis.. Welcome to the No.1 3D Swertres Hearing site in the .

PH0 · within 30 days meaning

PH1 · what is a net 30 account

PH2 · net 30 vs net 60

PH3 · net 30 terms form

PH4 · alibaba net 30

PH5 · Iba pa

PH6 · 30 day payment terms wording

PH7 · 1% 10&25 net 30 terms

PH8 · 1 % 10th 25th net 30

Indoor Walking Track Hours of Operation. Calendars Field House Entrance September 9 – December 20 Lincoln-Way West: Monday, Wednesday-Friday, 6:00-9:00pm Lincoln-Way Central: Monday, Wednesday-Friday, 6:00-9:00pm. Track Information. Age 18 & Older. A temporary walking pass will be provided at the Park District check-in desk at the Field .

net 30 meaning*******Net 30 is a term included in the payment terms on an invoice. Simply put, net 30 on an invoice means payment is due thirty days after the date. For example, if an invoice is . Tingnan ang higit pa

Payment terms like net 30 are essential to include on an invoice because they clarify when you want to be paid. This ensures clarity resulting in timely payments. It also increases your chances of being paid on time. . Tingnan ang higit paYou may be asked to pay your invoices immediately when you are a new customer or new business. When a vendor gives you a vendor account and a net 30 payment period, they extend credit to you and trust . Tingnan ang higit pa Net 30 means a customer has 30 days to pay an invoice. Learn how to use this term, adjust it for different customers and automate invoicing and payment .Net 30 means you offer your clients up to 30 days to pay for your goods or services. Learn why some businesses use net 30 terms, how they affect your cash flow, and what . Net-30 refers to the time frame in which a customer must pay the full amount of a vendor's invoice within 30 days or less. It .

Net 30 payment terms state that a customer has 30 days to make a payment after they receive an invoice. They are flexible and may help improve cash . Net 30 is a payment term that lets a client know they should pay an invoice in full within 30 days of receiving it. It's a form of trade credit that allows a .net 30 meaning net 30 vs net 60 Net 30 is a short term of credit that the merchant extends to the buyer within 30 days of the invoice date. It is used when a job is complete, such as a .

Net 30 payment terms and “due in 30 days” generally refer to the same outcome: your supplier wants you to pay the invoice in one month. A net 30 payment term is common . Net 30 refers to the amount owed in full, less any discounts and deductions. Is Net 30 the Same as Due in 30 Days? In essence, no, because net 30 is a credit term . Net 30 means the customer has 30 days to pay the total of an invoice. Learn how to offer or use net 30 terms, the pros and cons, and how to calculate the due date.What does “net 30 EOM” mean? Net 30 end of the month (EOM) means that the payment is due 30 days after the end of the month in which you sent the invoice. For example, if you and your client agree to net 30 EOM and you invoice them on May 11th, that payment will be due on June 30th—in other words, 30 days after May 31st.

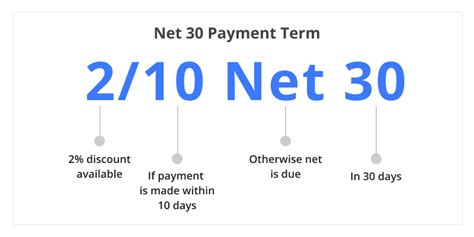

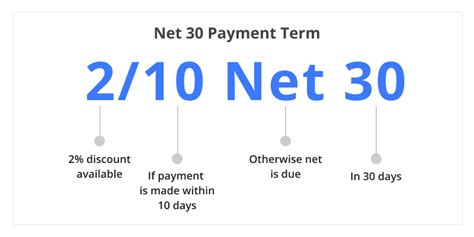

net 30 meaning For example, if "$1000 - 1%/10 net 30" is written on a bill, the buyer can take a 1% discount ($1000 x 0.01 = $10) and make a payment of $990 within 10 days, or pay the entire $1000 within 30 days.net 30 vs net 60 Net 30. Net 30 is a short term of credit that the merchant extends to the buyer. Usually, Net 30 on an invoice is used when a job is complete, e.g. a product or service has been sold but the payment has not been made in full. The 30 day period includes the time products spend in transit to the end-consumer. . 1/10 Net 30 means . Net 30 (sometimes written as net-30) refers to the number of days a client has to pay a bill in full after a certain action has been completed. In accounting and finance, this is called the credit term. While net 30 always means within 30 days, when the clock starts ticking is up to you.

Net 30 means the buyer has 30 calendar days to pay back for purchased goods and services. This could mean 30 days after: When the payment term is ‘Net 30 EOM’, it means that the customer has 30 days after the end of the month to pay back an invoice. A “2/10 Net 30” means that if the client pays back within 10 days, they get a 2% discount. Net 30, a term found on invoices, simply means a customer has 30 days from the invoice date to pay the bill in full. For example, if your client’s invoice date is May 1 with net 30 terms, payment would be due on May 31. Net 30 is one of several common payment terms used in business, with other examples including net 60 and due on receipt.Focus On Understanding the Meaning and Significance of “Net 30” In the business world, Net 30 is a term you’ll frequently encounter. It’s a common payment term with significant implications for buyers and sellers. Understanding its meaning and significance can help businesses manage their cash flows more effectively. Breaking down .Net 30 is a term used for payment purposes between a buyer and a seller. On an invoice, the ‘net days’ show that when the payment is due, we say that 30 days here are taken as 30 calendar days not working or business days. ‘Net’ in its exact meaning is; the total amount payable after all discounts are deducted from it.

Net 30 is a payment term that lets a client know they should pay an invoice in full within 30 days of receiving it. These 30 days are calendar days (not business days), so it includes weekends, holidays, and working days. . Net 60. On an invoice, net 60 means payment is due within 60 days of the invoice date. As a small business, a 60-day .

Net 30 is a form of trade credit. It means your client has 30 calendar days from your invoice date to pay the amount due. After that due date, you can charge interest or take other steps to collect payment. This payment period is based on calendar days, not business days. Many medium to larger small businesses use Net 30 payment terms.

Net 30 is a term used on invoices to describe the deadline for payment of an invoice. Net 30 means that payment is due within 30 days of when the invoice is received. Essentially, a seller who sets payment terms of net 30 is extending 30 days of credit to the buyer after goods or services have been delivered.Net 30 means the payment is required within 30 days of the invoice being received. In some cases, the 30-day period can refer to the delivery of goods or another agreed-upon criteria. How and when a buyer pays .

The Net 30 payment terms meaning may vary in some cases. The payment terms of Net 30 can vary depending on the start date. If payment terms are Net 30, the customer can pay you up to 30 days after the date you choose. It’s important for the company and customer to agree on this date. The beginning date can include the . Offering net 30 terms can help to broaden your customer base tremendously, as many customers appreciate the 30-day payment option, particularly those that may be experiencing cash flow problems of .Net 30 is an invoice term describing the deadline for payment of an invoice—in this case, 30 calendar days. Learn to understand discount terms like 2/10 net 30. Product. Accounts Payable. Approve, pay, and sync bill payments. Accounts Receivable. Send .Net 30 is a term used on invoices to describe the deadline for payment of an invoice. Net 30 means that payment is due within 30 days of when the invoice is received. Essentially, a seller who sets payment terms of net 30 is extending 30 days of credit to the buyer after goods or services have been delivered.Net 30 billing is an invoicing term that means the recipient of an invoice is expected to pay it in full within 30 days of the date it was received. It’s effectively a “trade credit” that your business offers to your client. For example, if you were to send out an invoice on January 2, 2020, you would expect payment on or before February . Due In 30 Days. The phrase “Net 30” in business means that a customer must pay the full amount due within 30 days. If it reads “due in 30 days,” payment is to be made in 30 days. Some businesses offer incentives to clients, such as “2.5 percent 10, net 30,” to encourage payment before the legally required 30 days have passed.

In the event of any dispute arising out of or in connection with the Lucky Draw, the decision of Swire Coca-Cola Hong Kong shall be final and conclusive. This lucky draw is held in Hong Kong. These terms and conditions are governed by and construed in accordance with the laws of Hong Kong and each Eligible Participant submits to the .

net 30 meaning|net 30 vs net 60